Having a modest business calls for plenty of awareness of details, then one vital aspect of business administration is handling the budget. Nevertheless, not all banking companies are compatible with smaller businesses. Several banking institutions offer you high quality professional services that might not be financially smart for small enterprises. Nonetheless, tide bank is different it’s a monetary organization that accommodates small enterprises, delivering bespoke business banking options that suit them very best. In this post, we are going to go on a extensive take a look at Tide bank and just how it might enhance your business banking encounter.

1. What is Tide bank, and just how would it be Various?

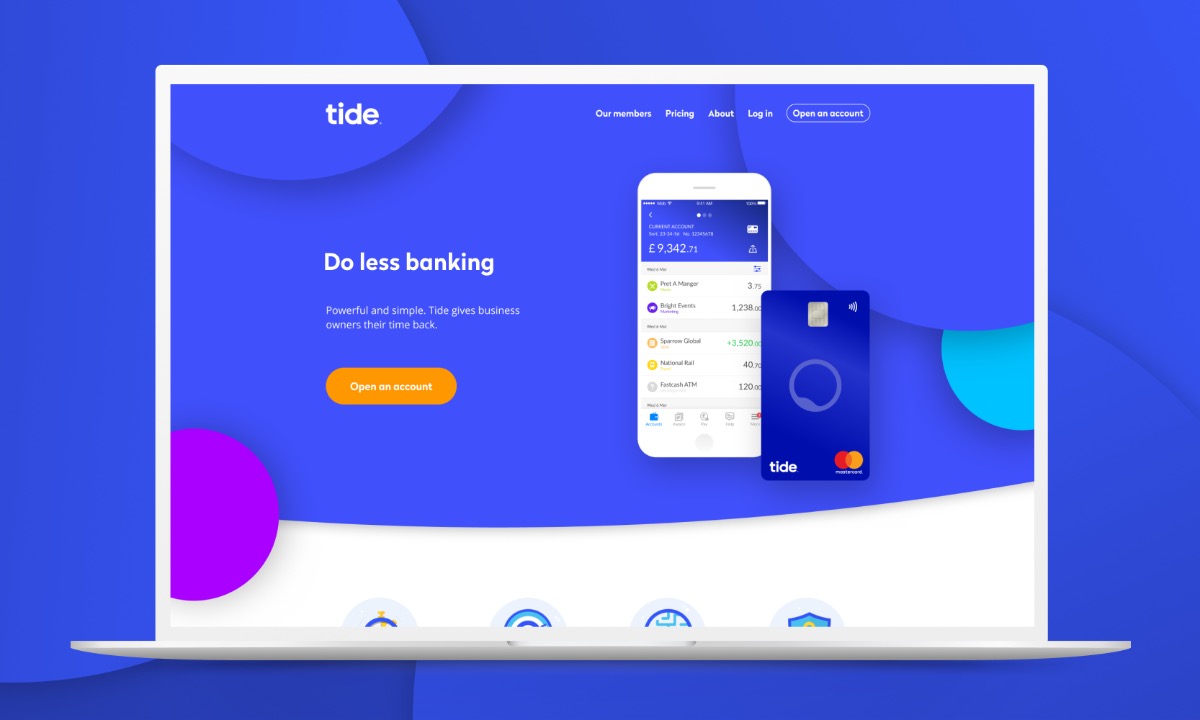

tide business account is a computerized bank created mainly for smaller businesses in the UK. Most conventional financial institutions provide a one particular-dimension-fits-all assistance version that doesn’t serve particular modest business requires. On the contrary, Tide bank understands and prioritizes the particular financial requires of modest business users. You don’t should give quite a few files or physically look at the bank to open a Tide account. In a handful of steps, it is possible to open your account in document time, which helps save money and time.

2. Smoothly Deal with Your Business Financial situation

Managing business funds is time-ingesting and will be mind-boggling, particularly if you don’t have got a specialized economic expert or bookkeeper. Luckily, Tide bank has an instinctive online-based application that gives effortless-to-recognize financial records. It is possible to see your finances, track your deals, and gain access to additional features effortlessly about the iphone app. Furthermore, you get a wise business Mastercard without annual charges, so that you can easily deal with your expenses, regardless of whether you’re moving around.

3. Track and Control Your Expenses

As mentioned above, handling expenses is an important element of small businesses. Luckily with Tide bank, you can easily keep track of your bills. You are able to categorize expenses, establish a spending budget, and monitor your investing. These features are advantageous, especially if you’re seeking to make any costs cuts. You may also customize it to demonstrate the expenses associated with certain tasks, that makes it simpler for taxation purposes.

4. Wise Business Lending options

Just about the most frequent obstacles little business users deal with is loans, and accessing business loans could be a long and sophisticated method. However, Tide bank delivers intelligent business lending options made to match little business owners. You are able to obtain a financial loan right from the app, and you could complete the method in about 5 minutes. The personal loans don’t require possessions as collateral, as well as the personal loan terminology are adaptable, which makes it simple to handle.

5. Why Choose Tide bank?

Tide bank ought to be your go-to bank if you’re a small business owner. It offers bespoke banking services, helps you save time and money, and it has an instinctive app you could accessibility just about anywhere, any time. Also, Tide bank has affordable charges you will find no invisible costs, which can be an important charge saver. Finally, the bank is dependable and protect you are able to rest easy knowing your hard earned dollars is safe.

In short

To conclude, Tide bank is a bank constructed exclusively for smaller businesses. It suits small business owners’ economic demands, supplying bespoke business banking solutions, and gives an easy-to-use mobile app that helps you manage your money successfully. The bank is dependable and safe, and also the charges are affordable, so that you can center on developing your business. So, head over to Tide bank’s website now, open an account, and expertise hassle-totally free business banking.